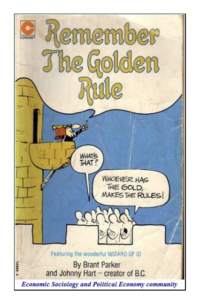

Remember the Golden Rule! Whoever has the gold, makes the rules!

The banks have the money, the banks make the rules, and the rules are changing in our COVID world. We thought you’d see what’s going on in the banking and appreciate all of these bankers for taking the time to share their thoughts with us.

The following information shows the bankers we talked with, the topics, and what each banker relayed to us on the four topics. There’s a lot of information, it’s in bullet point format, and we will stress the best initial step for borrowers is to get to know bankers and build relationships.

We want to thank all of these bankers for taking the time to share their thoughts. Their email addresses are at the end of the report for ease of contacting them.

Banks and Bankers Who Shared Their Thoughts

Banner Bank – Lynell Smith & Jacque Coyan

Columbia Bank – Jeff Wilcox

Heritage Bank – Addie Roberge

Key Bank – Jane Pekasky & Jennifer Ringenbach

Live Oak Bank – Lisa Forrest

NW Bank – Gary Strand

Sound Credit Union – Donna Himpler

WA Trust Bank – Kit Gerwels

Topics discussed, referenced below by number:

- What’s changed and the bank’s appetite for buy-sell loans

- Industries not preferred at this time

- Underwriting changes due to COVID

- Tips for borrowers

Live Oak Bank – Lisa Forrest

1. Open for business, looking for deals, are actively underwriting and closing loans We like essential services businesses. We have questions about elective health care and software catering to Non-COVID resistant industries. Must have YTD monthly statements for 2020 and 2019 first. Then, look at the prior three years with an emphasis on 2019.

2. Not doing motel/hotel, airline-related, med spas, anything that brings people together like family entertainment, bouncy houses, etc.

3. COVID questionnaire is a must Their “box” hasn’t changed per se. Will want appropriate levels of seller financing (that might entail larger seller notes or enhanced seller terms, especially if mitigating any uncertainty) Will want more seller financing (larger seller notes). We expect the borrower to do their required homework.

4. 2020 financials are a must Keep an eye on 2nd phase of the virus, the fall flu season, recession into 2021. Business sellers need to be aware of what’s going on and realistic, especially if customers are in industries mentioned in point 2. Need to understand the business’ customers and any risks to revenue channels and the entire supply chain. There are no experts right now on what’s going on or will go on.

Banner Bank – Lynell Smith & Jacque Coyan

1. Will now want 15-20% and at least 20-25% from buyer/seller combined Will look at projections more, just like starting in 2009 Why and how has COVID affected the business now and in the future. Cautious on loans when the business depends on retail stores or is a retailer. Emphasized will want buy-sell deals but with more down from the buyer.

2. Restaurants

3. Getting more conservative; not overlooking it when there are a couple of little issues. Must have a good business plan. Borrower quality is important, and industry experience and knowledge are deciding factors. Will pay attention to who referred the deal to the bank.

4. Have patience – it will take longer Will need good, detailed information. If advisors are involved it’s a big plus Have structure and story prepared and well presented.

NW Bank – Gary Strand

1. Open for deals and pausing on some things until the fog lifts Treating COVID like 2008 and 9/11 – what’s the unknown. Will move to SBA 7A program or pause if not enough collateral (on conventional loans). (NW Bank had done conventional acquisition loans emulating the SBA program). Retreating to the laws of “finance gravity”. There’s a heightened discipline around pricing. We know there’s a 10-12-year cycle and we’re all (all bankers) rusty with distressed loans.

2. Nothing new but they don’t do cannabis or guns.

3. See point one.

4. Know the appropriate debt-equity ratio and the amount of the down payment. Be thoughtful about the amount of debt. Do your own sensitivity analysis (aka stress test, how the loan will perform if business declines by various percentages) – what does it look like if there’s a 30% drop in revenue. Engage banks earlier, and get multiple opinions (multiple banks), this is more important now than before. Realize emotions are heightened; if a bank doesn’t want your (good) business it’s probably asset allocation not personal; the bank is making an “investment” based on the bank’s risk tolerance, not the buyer or seller’s.

Columbia Bank – Jeff Wilcox

1. Open for business Moving more to SBA 7A that they would have done conventional pre-COVID. Examples – one too small ($1.2 million), would have passed, did SBA and another had a lot of goodwill (no collateral), would have done conventionally last year but did SBA now. More forward modeling with a greater degree of stress. More conservative lending with more collateral.

3. Doing a COVID analysis, pre- COVID present- COVID, future and recovery from COVID. And wanting to understand the long-term industry effect. Digging in further on the business/industry.

4. Have a strong internal accounting infrastructure. The owner should understand the financials and how they relate to operations. Want to see a strong CFO or controller. Owners should know how to manage expenses. Be realistic about where the business is going; talk candidly and with realism to your banker about any challenges and how you will handle them; those to address this instead of saying all will be great will go further with the bank.

WA Trust Bank – Kit Gerwels

1. Open for business and prefer strategic buyers, especially existing customers, then they will look at other deals. Will be asking – what recourse does the bank have? Valuation – is it accurate; forecasting, how can we perform diligence with unreliable projections.

2. No list of businesses they won’t lend to. Will gravitate to the client’s expertise, the relationship manager’s expertise, and the deal itself.

3. Underwriting has not changed – will be consistent with past practices.

4. Get to know bankers. Talk holistically with bankers about how it all works. Have a good advisor to guide you. Talk to bankers early.

Key Bank – Jane Pekasky & Jennifer Ringenbach

1. KeyBank is making loans to clients. In addition to traditional loans, we are working on post-deal liquidity as well. We are also fielding questions and helping to find solutions for clients as all businesses have been affected by COVID-19 in one way or another.

2. We are certainly answering more questions about underwriting lately. But we still require the same percentage down from the buyer, higher seller notes may be required, but on a case-by-case basis.

3. More questions in underwriting (including COVID) Same percentage down from buyer, higher seller notes may be required on a case-by-case basis.

4. Talk to your bankers, we are here to help. Your bankers are trusted advisors, in good and hard times. PPP showed us how important that is. Take the time to write down your questions to the bank and understand the answers. This will help in the long run and assist us in helping you meet your needs.

Heritage Bank – Addie Roberge

1. Has shifted from all PPP to accepting acquisition loan applications. Seeing growing activity for acquisition loans.

2. CRE Retail financing is suspended along with vet and dental suspended until specific counties reopen (phase 2) Direct vehicle financing has stopped.

3. Will not fund if the business is temporarily closed due to COVID-19. If the business is partially in operation – we will dive in and use projections. Looks at the industry – If shut down again how would it affect the business. Stress testing. Year over year supply chain April 2019-April 2020 (A/R). Are the payments coming in slower?

4. Cash is king. The buyer needs to understand this is the “unknown” SBA will make customers’ payments on all SBA loans booked and fully funded by 9/27/2020.

Sound Credit Union – Donna Himpler

1. PPP is fading out – busy with acquisition loans. Liquidity has a new meaning. If necessary will hold liquidity into account 6-8 months.

4. SCU really hasn’t and isn’t changing the way they do things except for the liquidity part – the more the better.

Banker Contact Information

NW Bank – Gary Strand; gary.strand@northwest-bank.com

Live Oak Bank – Lisa Forrest; lisa.forrest@liveoakbank.com

WA Trust Bank – Kit Gerwels; KGerwels@watrust.com

Key Bank – Jane Pekasky & Jennifer Ringenbach; jane_pekasky@keybank.com jennifer_ringenbach@keybank.com

Columbia Bank – Jeff Wilcox; jhwilcox@columbiabank.com

Banner Bank – Lynell Smith & Jacque Coyan; Lynell.smith@bannerbank.com jacque.coyan@bannerbank.com

Heritage Bank – Addie Roberge; addie.roberge@heritagebanknw.com

Sound Credit Union – Donna Himpler; dhimpler@soundcu.com